Full Accounting Questions and Answers

Here is a list of full accounting questions and answers that can be found on this site, along with a brief description of each one. Please note that these are generally intermediate to advanced exercises.

I would definitely recommend to time yourself when you practice each of these exercises. This will help ensure you're not taking too long to complete each question and will help you get used to doing exercises under exam settings.

For your convenience, difficulty levels and time limits are stated for each of these exercises at the top of each page.

- A beginner-level quiz taken directly from the Accounting Basics books. 9 multiple choice questions which test the 1st theory chapter here on Basic Accounting Concepts.

- Covers the accounting equation, assets, liabilities, equity, financial position.

- 12 minutes

- For practice on the basic accounting equation and its 3 elements - assets, liabilities and owner's equity.

- Basic understanding of income and profit is preferable.

- 10 minutes

- Simple journal entries - starting a business (capital investment), asset purchases, paying creditors, cash income and expenses, drawings.

- Service business - no inventory but supplies on hand and used.

- 12 minutes

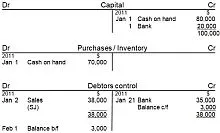

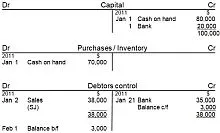

- Basic journal entries: capital investment, sales, debtors, simple cash expenses, drawings;

- Inventory business - simple purchases and sales journal entries;

- Practice with drawing up T-Accounts.

- 20 minutes

- No journal entries here;

- First part tests your understanding of the Creditor's Control Account;

- Second part of the question gives you practice on the Cost of Goods Sold formula.

- 10 minutes

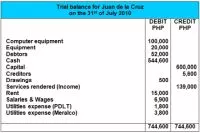

- General, basic journal entries: starting a business, debtors, creditors, regular expenses, drawings;

- Inventory business - purchases and sales;

- Some complex topics: discount received and allowed, carriage on goods.

- 25 minutes

- Basic journals - expenses owing, cash and credit sales, paying creditors;

- Inventory business - purchases and sales;

- Some complex issues: depreciation, prepayments, inventory loss (fire), discount received.

- 15 minutes

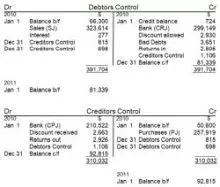

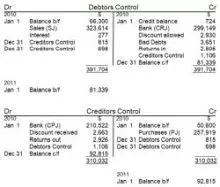

- Full debtors and creditors control accounts

- Some complex issues - bad debts, settlement or cash discounts received and allowed, returns inward and outward, account corrections, calculating closing balances.

- 30 minutes

- Full debtors and creditors control accounts (similar to exercise above)

- Bad debts, settlement or cash discounts received and allowed, returns inward and outward as well as account corrections and closing balances.

- 30 minutes

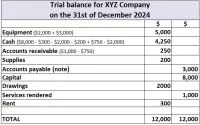

- Beginner level - capital investment by owner, basic income and expenses, purchase of assets, drawings, basic liabilities;

- Service business - no inventory, sales or cost of goods sold in this exercise.

- 15 minutes

- This is a really good question to practice.

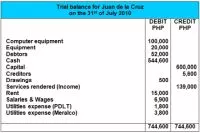

- Capital investment by owner; basic income and expenses, purchases of assets, drawings, basic liabilities;

- Service business - no inventory, sales or cost of goods sold in this question.

- 40 minutes

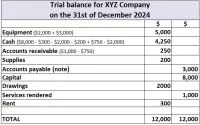

- Trial balance, income statement, statement of changes in equity and balance sheet,

- Inventory business - FIFO basis,

- Some complex issues - prepayments (prepaid expenses and prepaid income),

- Corporation-specific issues - stock, retained earnings (accumulated profits), dividends paid to shareholders.

- 75 minutes

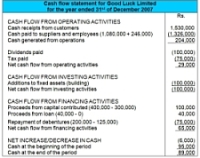

- Typical cash flow statement question where they supply the balance sheet, income statement and details about changes in owner's equity.

- Company-specific items such as share capital, reserves and debentures.

- Some complex issues in the form of preliminary and prepaid expenses.

- 35 minutes

Accounting Questions and Answers on Advanced Topics

Here are a bunch of questions on specialized topics submitted by fellow accounting students from around the world, with detailed explanations:

- What is the Journal Entry for Rent Received in Advance?

- What is the Journal Entry for an Insurance Claim?

- What is the Journal for the Partial Payment and Trade-In of a Vehicle, incl. Depreciation?

- What is the Journal Entry for Bad Debts?

- What is the Journal Entry for Recovery of Bad Debts?

- What is the Journal Entry for Giving Away a Free Sample?

- What is the Cost of Goods Sold Formula?

- Cost Price, Sales Price, Mark-up

- Carriage Inwards:Meaning, Treatment and Example

- How to Calculate VAT

- Settlement Discount Granted and VAT

- Accounting forDonations

- Why is the Provision for Doubtful Debts a Liability?

- Bad Debts, Provision for Bad Debts, Debtors Control

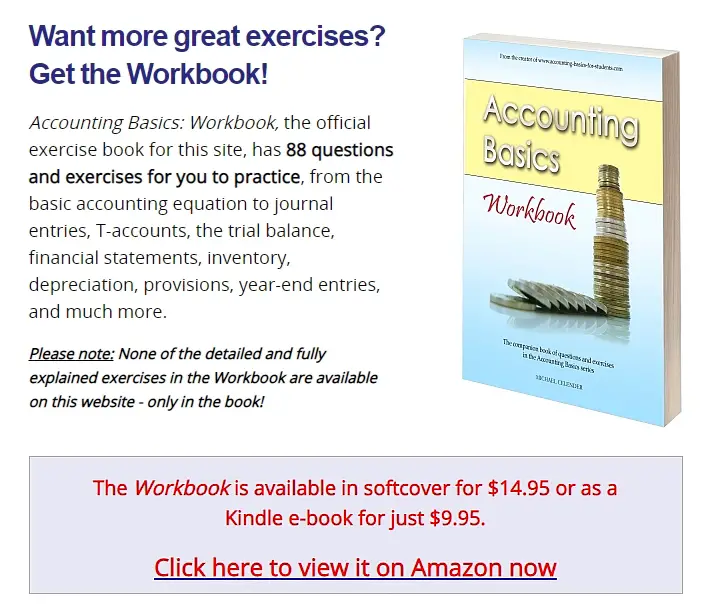

For More Practice - Get the Workbook!

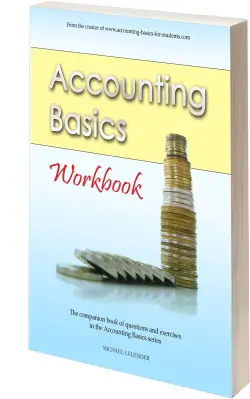

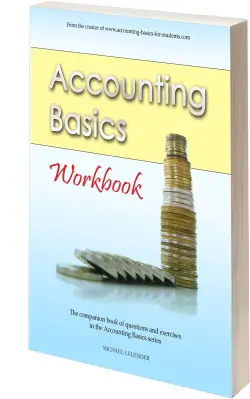

If you want more practice with full accounting questions and answers you should get the official exercise book for this site, Volume 2 in the Accounting Basics series:

the Workbook.

Accounting Basics: Workbook has 88 questions and exercises, starting from the accounting equation and basic concepts to journal entries, T-accounts, the trial balance, financial statements, the cash flow statement, inventory, depreciation, provisions, doubtful debts, year-end entries, bank reconciliations and more.

Please note: The detailed, fully explained exercises in the Workbook are not available on this site - only in the book!

The Workbook is available in softcover for $14.95 or as a

Kindle e-book for just $9.95.

Some testimonials from individuals who bought the Workbook:

"Really helps!"

"Very helpful."

"Learned very much from it, it was awesome."

"The workbook is a great review for me of the classes I took in College."

"The book is very interesting and easy to follow. I have to take a course in accounting for an online degree program that I am involved with and this book is a life saver. It explains clearly the information you need and has quizzes that are a tremendous help in grasping the material."

Rated 4.8 out of 5 by Amazon customers.